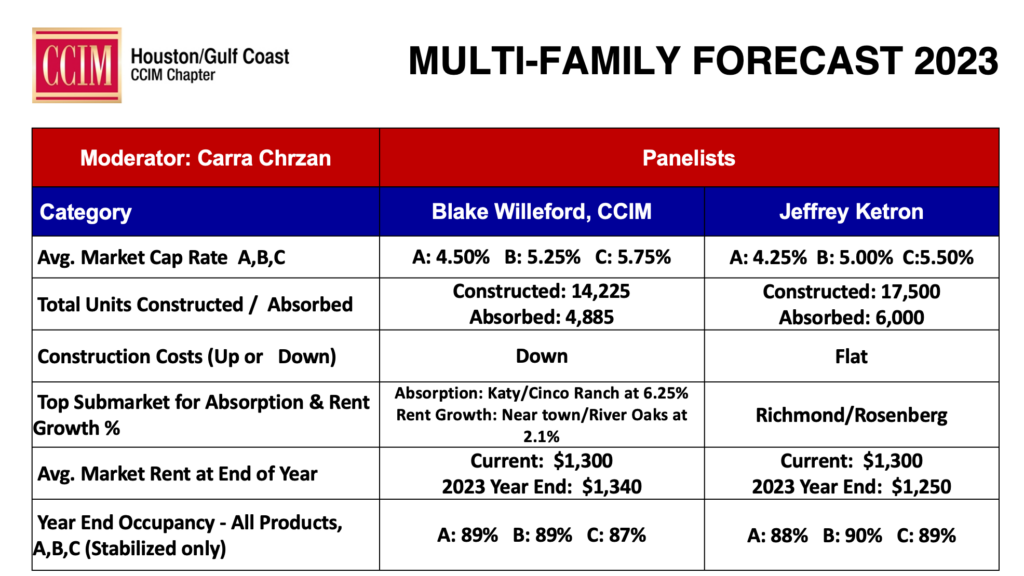

By Patsy Fretwell – During this year’s CCIM Forecast Competition, multi-family experts Blake Willeford, CCIM with Greystone and Jeffrey Ketron with Northmarq offered their perspectives on the market and offered predictions for 2023.

With all costs in the multi-family sector increasing, the two agreed they are cautiously optimistic for smaller trades. Institutional groups are active with more buyers and potential investors evaluating opportunities and looking at environmental risks. Both expect construction costs to decrease or remain flat.

Willeford and Ketron also agree the market is not in sync; sellers still expect prices that may not be realistic. Buyers and sellers are getting closer together with some tightening due to rent improvements and lower vacancies. And land prices are not dropping as sellers are still waiting for the best deal.

The top submarkets projected to have the highest absorption and rent growth in 2023 include Katy/Cinco Ranch and Near Town/River Oaks, according to Willeford. On the other hand, Ketron believes Richmond/Rosenberg will be on top. Both forecasters reported the current average market rent is $1,300. However, Williford thinks the rate will increase 3.1% to $1,340, while Ketron believes the average rent will decrease 3.9% to $1,250 by year-end 2023.

Patsy Fretwell is a guest contributor with more than 30 years of experience in real estate market research.

CommGate, the commercial division of the Houston Association of REALTORS®, is a CCIM partner and a long-time sponsor of the CCIM Houston/Gulf Coast Chapter’s annual forecast competition.